June 05, 2015

In December 2010 the Illinois General Assembly passed and then Governor Quinn signed legislation (Public Act 96-1495) that created a new tier of pension benefits for public safety employees in Illinois hired on or after January 1, 2011, including Chicago police and firefighters. The legislation also significantly changed the City of Chicago’s employer contributions starting five years later in budget year 2016. The statutory schedule requires an increase in funding in 2016 of over $500 million with a goal of a 90% funded ratio by 2040. New legislation passed by the Illinois General Assembly before it recessed at the end of May 2015 would put the City on a longer funding plan with a five-year “ramp” that would reduce the jump in pension contributions by $220 million if the bill is signed into law by Governor Rauner.

Prior to 2016, the City of Chicago’s statutorily required employer contributions to its Police and Fire funds were based upon a multiple of what employees contributed two years prior. For the Police fund, the multiple was 2.0 and for the Fire fund it was 2.26. These multiplier contributions do not adjust according to the actual cost of providing the benefits, so even though the City has made its required contributions under state law, they have been insufficient for the actual needs of the Police and Fire funds for many years. Statutory underfunding is one of the biggest contributors to the funds’ huge unfunded liabilities, which the new funding plans are intended to address. For more information about how consistent underfunding of a pension fund can be damaging, see the Civic Federation’s Plain English Guide to Illinois Pensions. The most recent information available, which is as of December 31, 2013, show the Police and Fire Funds with actuarial funded ratios of only 29.6% and 24.0%, respectively.

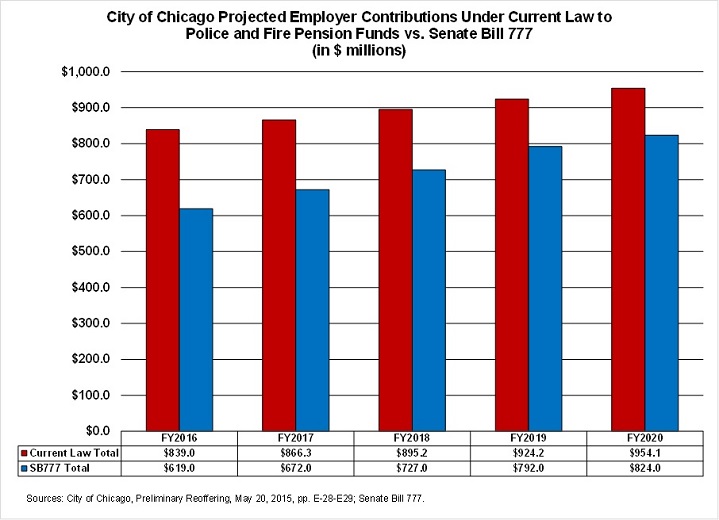

As referenced above, under current law, the City of Chicago is required to increase its contributions in budget year 2016 such that the funded ratios of the Police and Fire funds increase over 25 years to reach 90% by the end of 2040, using a level percentage of payroll (see the Civic Federation’s Status of Local Pensions reports for description of this method). The change from the multiplier-based contribution in budget year 2015 of $300.6 million for both funds to the actuarially-calculated 25-year funding plan contribution required by P.A. 96-1495 for budget year 2016 of $839.0 million will require a significant increase in revenue, spending cuts or both, and contributions will only grow in subsequent years as payroll grows, reaching $954 million in FY2020, $1.3 billion in FY2030 and $1.5 billion in FY2040, when the funds are projected to reach 90% funding.

Mayor Emanuel has said in the past that the City cannot afford to make the increased Police and Fire pension payment without also negotiating reforms to pension benefits that decrease their cost. However, in the wake of an Illinois Supreme Court ruling that a state pension benefit reform package for current employees and retirees was unconstitutional, it is unknown whether any benefit changes for current Police and Fire employees and retirees could pass the General Assembly or if they would be upheld in court. After being downgraded by Moody’s Investors Service below investment grade in the aftermath of the Illinois Supreme Court decision, the City announced in recent bond documents that it was negotiating with its public safety unions to moderate the spike in its pension payments by extending the amount of time it is given under state statute to increase funding levels and including a five-year step-up period to get to the higher actuarially-calculated funding. Since pension benefits and funding are controlled by Illinois State law, any change to the funding program must be implemented through legislation in the Illinois General Assembly.

Senate Bill 777, as amended in the House, lays out five years of steadily increasing payments to the City’s public safety funds until it reaches a level where it starts to contribute enough to raise the funded level to 90% over 35 years for a total 40-year funding plan. This five-year ramp to a 35-year plan to 90% funded is similar to the funding plan included in pension reform legislation passed in 2014 for the City’s other two pension funds. The amount the City must contribute each year to each fund between FY2016 and FY2020 is specified in dollar amounts in the legislation. Projections of the contributions that will be made under the actuarial calculations in budget year 2021 (tax year 2020) and beyond have not been made available. The City has also not released an official, comprehensive plan for how it would afford even the lower payments, though it is pursuing legislation that would allow a casino in Chicago. The following chart compares the projected contributions made under current law from FY2016-FY2020 to the specified contributions under Senate Bill 777.

It is important to note that since the City’s contributions in FY2016-FY2020 are laid out in statute, they will not adjust should the funding needs of the pensions change due to lower than expected investment returns or other deviations from actuarial expectations. City officials have said that the amount of funding in the five-year ramp is sufficient to increase the funded ratios of the pension funds over each of those years. However, if the fund experiences unfavorable results in the next five years compared to actuarial expectations, contributions would not compensate for those changes during the ramp and could possibly lead to a fall in funding levels.

Other provisions of the legislation would create minimum pension levels in comparison to the federal poverty level for police and firefighters over age 50 with 20 years of service; provide that any proceeds received from a new casino in Chicago would go toward the City’s payment of its Police and Fire pension funds obligations; and clarifies that the pension funds can bring mandamus action in Cook County Circuit Court to compel the City’s payment of pension obligations.

Neither the current statutory payment schedule allowing the City 25 years to reach 90% funded nor the payment schedule under Senate Bill 777 allowing 40 years to reach 90% funded with a five-year ramp are best practice funding schedules from an actuarial perspective. There is no best practice for an acceptable funded ratio other than 100%.[1] The Civic Federation understands the City of Chicago’s wish to lower its contributions to its Police and Fire funds in order to lower the burden on residents, but it is important for all stakeholders to recognize that stretching payments out over 40 years means pushing more of the cost of today’s employees and retirees onto tomorrow’s taxpayers and impairs intergenerational equity.

The Civic Federation urges the City of Chicago and Illinois General Assembly to publicly release any actuarial studies that show how the funding levels of the Police and Fire funds would be impacted by the legislation. After passing both houses of the Illinois General Assembly, SB777 has not yet been released for review by Governor Rauner. The Governor has not indicated whether or not he will sign the bill, but he has been critical of it, characterizing it as “kicking the can down the road.”

The legislative package referenced above that was passed in 2014 and makes changes to the benefits and funding of the City’s other two pension funds, the Municipal and Laborers’, is being litigated in Cook County Circuit Court. Oral arguments in the case are scheduled for July 9th.

__________________________________________________________________________________________

[1] American Academy of Actuaries, “Issue Brief: The 80% Pension Funding Standard Myth,” July 2012. http://actuary.org/files/80%25_Funding_IB_FINAL071912.pdf